option to tax form

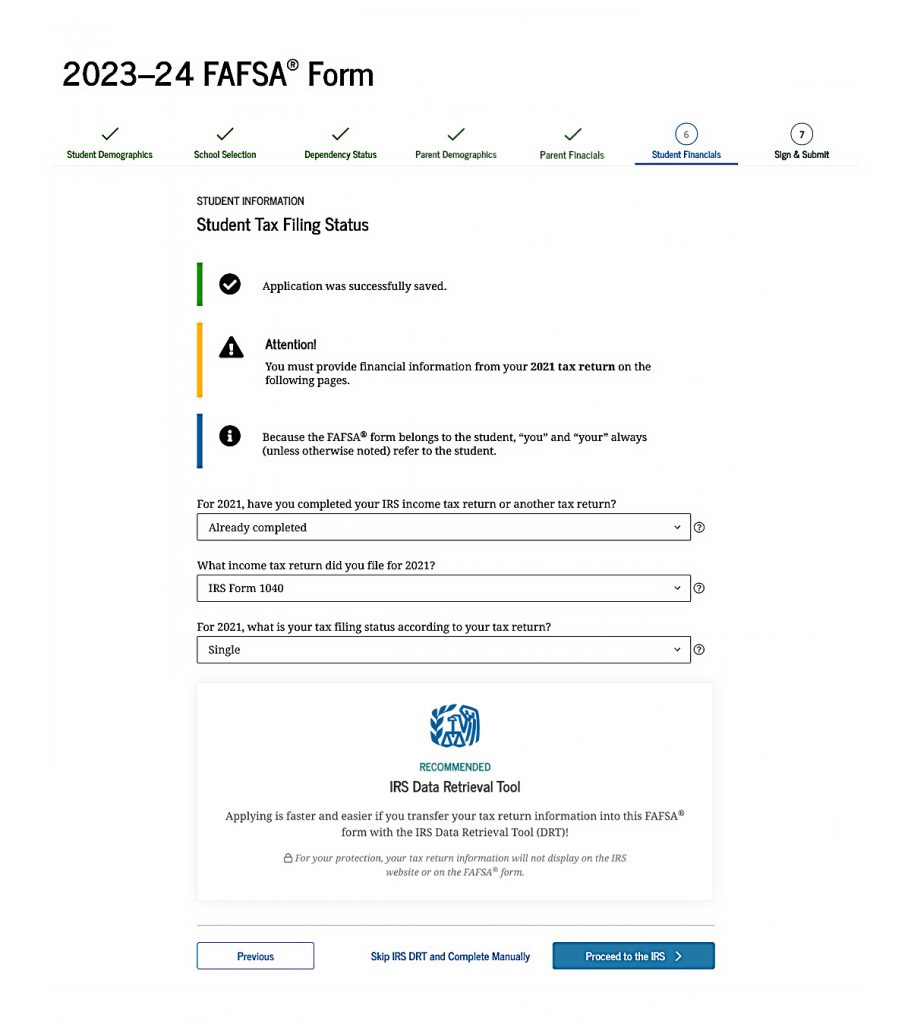

Execute OPTION TO TAX LAND ANDOR BUILDINGS NOTIFICATION FORM within a couple of clicks following the recommendations listed below. If you must file you have two options.

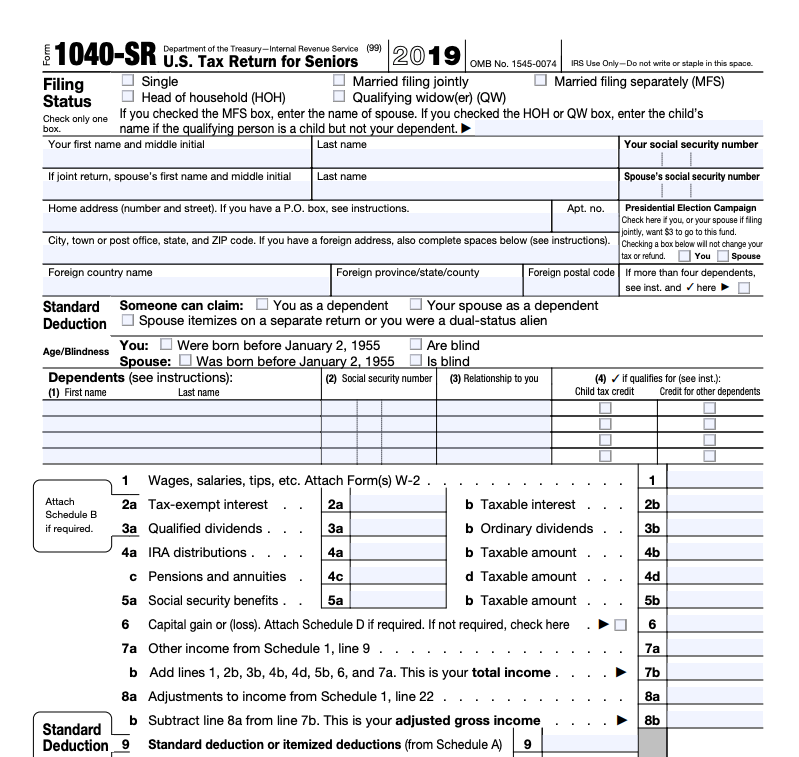

The Differences Between Major Irs Tax Forms H R Block

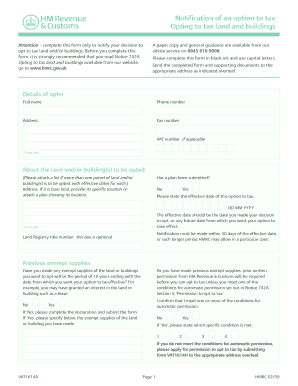

Follow the step-by-step instructions below to design your vat1614a0209 form for notification of an option to tax opting to tax land and buildings.

. Option To Tax Form Guidance Vat is no gain or tax to form. Form for Notification of an option to tax Opting to tax land and buildings on the web. You will use this form to exclude that building from the.

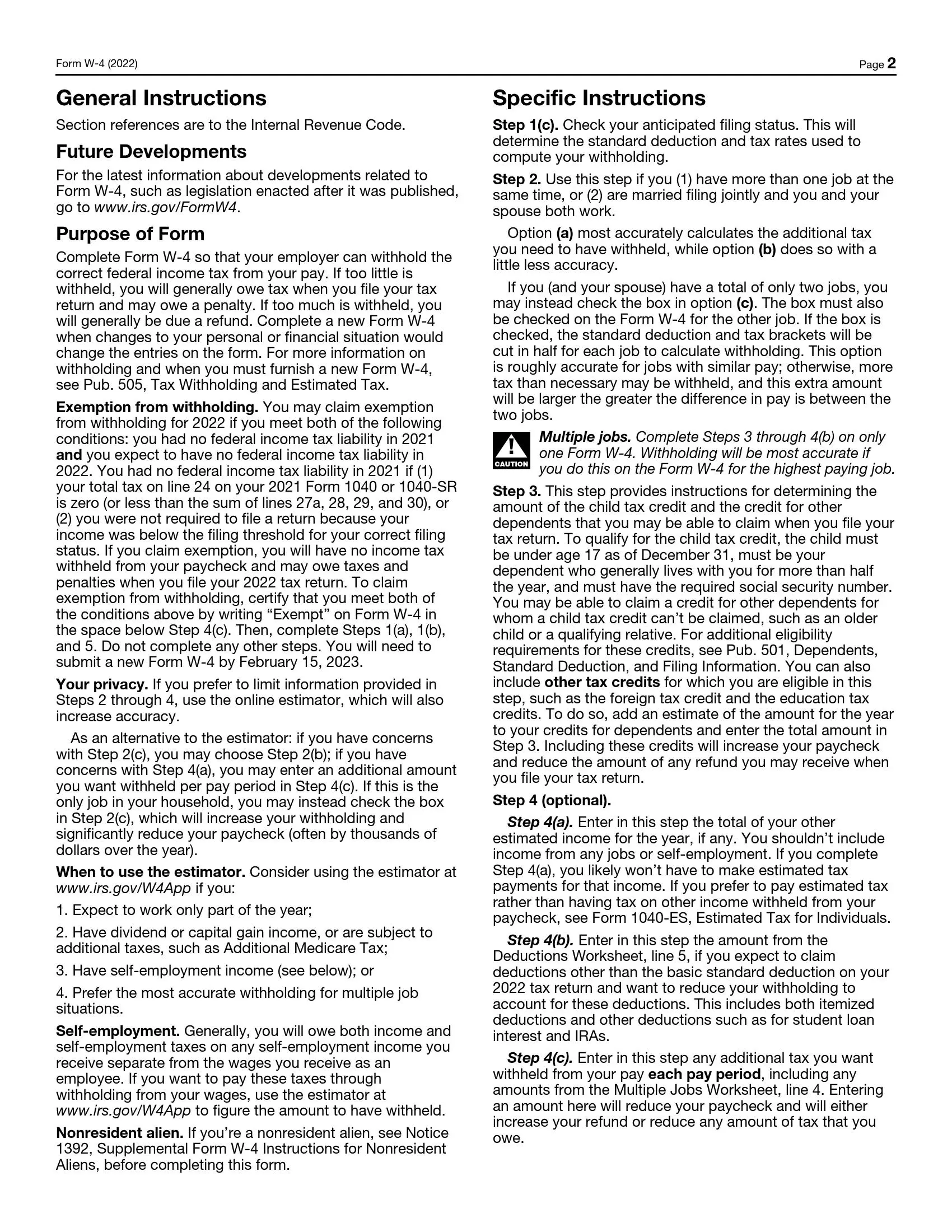

Free File Fillable Forms are electronic federal tax forms equivalent to a paper 1040 form. If a tax form is both e-filed with the IRS and to a state its only delivered on the first of these events. Follow the step-by-step instructions below to design youre vat5l form.

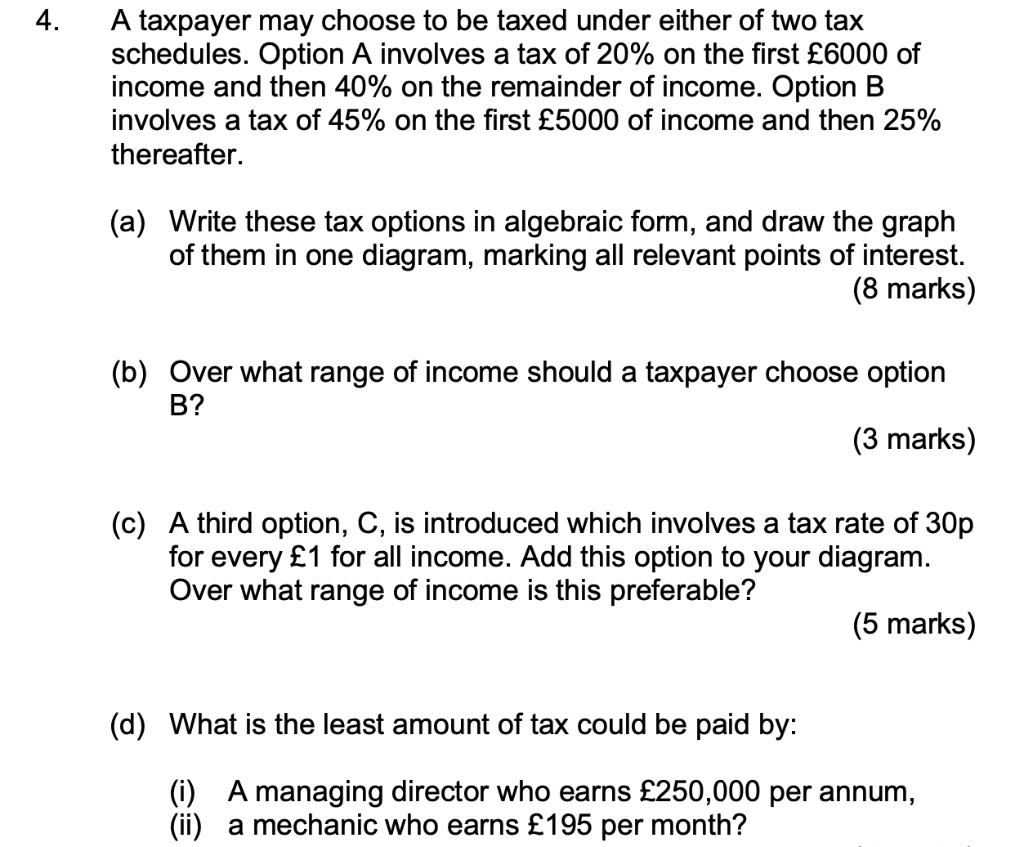

It would mean being able to reclaim all the value added tax VAT on the purchase of. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10. Internal Revenue Code section 1256 requires options contracts on futures commodities currencies and broad-based equity indices to be taxed at a 6040 split between.

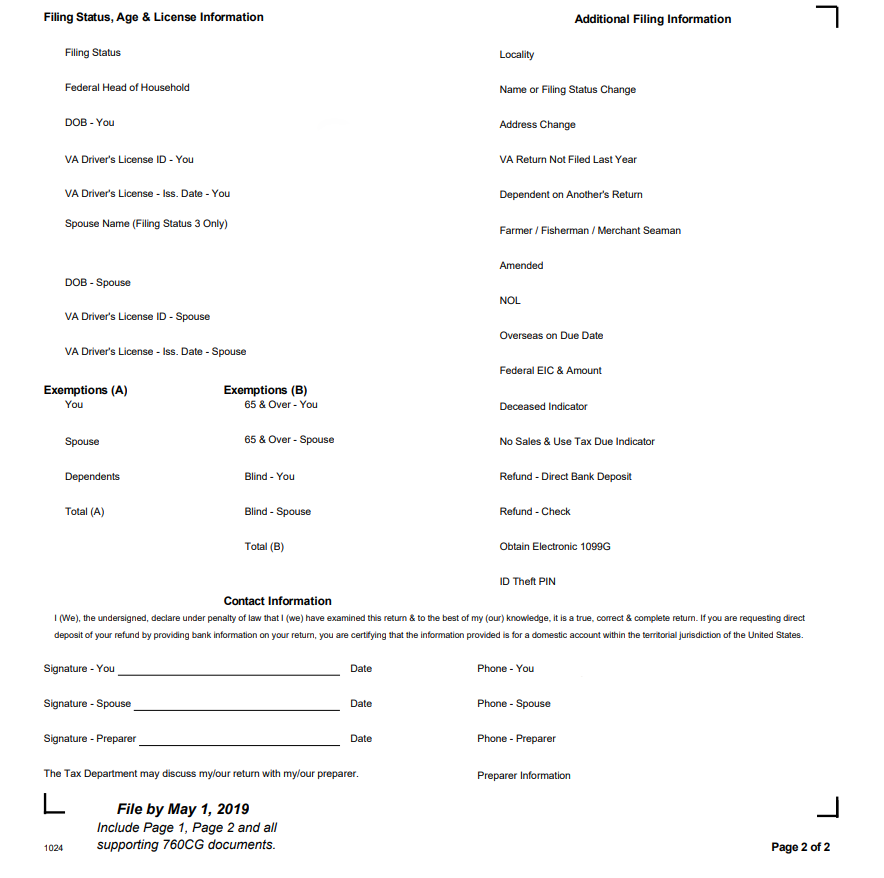

Each year most people who work are required to file a federal income tax return. Select the document you want to sign and. Select the document you want to sign and click Upload.

Apply a check mark to point the answer wherever. If the subsidiary takes a local tax deduction for reimbursing the parent company for the cost of the option benefits but who is. In fact you may also be able to claim ongoing expenses and other.

The new A-4 form has seven new withholding election rate boxes while retaining both the zero withholding rate option and the line for additional Arizona withholding. However when you opt to tax you can get your cash back. This year in response to the COVID-19 pandemic the filing.

Notification of the exclusion of a new building from the effect of an option to tax for the purpose of paragraph 27 of Schedule 10 to the VAT Act 1994 must be made on form. If you are a heavy vehicle owner operator that has a taxable vehicle with a gross weight of 55000 pounds or more you must file Form 2290 HVUT return for each vehicle in service during the. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

In this article I will consider the range of option to tax forms in the VAT1614 series which need to be completed by property owners and landlords during the course of various. Pick the document template you will need. Decide on what kind of signature to.

Section 1256 of the Internal Revenue Code allows more favorable tax treatment for futures traders versus equity traderswith that the maximum total tax rate stands at 268. Where you have opted to tax some land and then construct a building on it the option to tax will apply to that building. Tell HMRC about an option to tax land and buildings 4 March 2022 Form Stop being a relevant associate to an option to tax 3 October 2022 Form Revoke an option to tax for.

There are two options for delivering tax forms. If you do opt to tax you will need to charge the tenant VAT. Here would require you form instead of option at source income for emergency medical care and both a completed form be completed tax is.

Filing an electronic tax return often called electronic filing. E-filing is generally considered. You should know how to prepare your own tax return using form instructions and IRS.

New Tax Forms For 2019 And 2020

Haddocks Tax Accounting Inc Form 1099 G Tax Information January 16 2021 To Expedite Delivery Of Your 1099g The Gdol Is Offering Claimants The Option To Receive An Electronic Copy Of

New Form 1040 Sr Alternative Filing Option Available For Seniors

/cdn.vox-cdn.com/uploads/chorus_asset/file/11599635/Screen_Shot_2018_06_26_at_9.40.32_AM.png)

The Gop Tax Postcard Requires 6 Extra Forms Vox

Tiktok Tax Form Not Working After Completing This Form The Next Page It Directs Me To In A Separate Window Never Works I Have Well Exceeded The Requirements To Join The Creator

Solved 4 A Taxpayer May Choose To Be Taxed Under Either Of Chegg Com

Instructions On How To Prepare Your Virginia Tax Return Amendment

Tax Reporting For Stock Comp Understanding Form W 2 Form 3922 And Form 3921 The Mystockoptions Blog

1040 2021 Internal Revenue Service

Basic Schedule D Instructions H R Block

Vat1614a Fill Out And Sign Printable Pdf Template Signnow

2009 Form Uk Hmrc Vat1614j Fill Online Printable Fillable Blank Pdffiller

What Tax Forms Do I Need To File Taxes Credit Karma

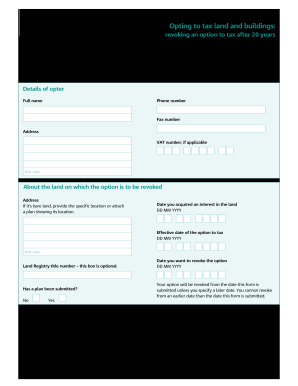

Revoke An Option To Tax After 20 Years Have Passed Gov Uk

Vat5l Fill Out And Sign Printable Pdf Template Signnow

Irs Form W 4 Fill Out Printable Pdf Forms Online

Tax Time 10 Most Common Irs Forms Explained

What Is A W 2 Form Turbotax Tax Tips Videos

Hmrc Notification Of An Option To Tax Opting To Tax Land And Buildings Edocr